Company Incorporation in Japan

Expanding into Asia’s most resilient economy starts with understanding the essentials of company incorporation in Japan. Whether you're launching a new venture or establishing a subsidiary, Japan offers a well-defined legal structure and a business-friendly environment that rewards preparation and precision.

The process may appear intricate, but with the right guidance and clear steps, it becomes far more accessible. Knowing the key stages, the documents required, and the expected costs allows you to plan confidently and avoid delays. This guide will walk you through everything you need to know, from choosing the right company structure to completing the registration process, so you can set up your operations in Japan with clarity and purpose.

On this page

Fast facts about doing business in Japan

Foreign ownership is allowed in most sectors, and there are clear regulations to protect both local and international investors.

With strong infrastructure, a highly educated workforce, and a reputation for quality, Japan continues to attract businesses seeking sustainable growth in Asia.

Let’s take a closer look at the key factors that make Japan such a powerful destination for incorporation.

Japan’s GDP exceeds $4 trillion, and the country maintains one of the lowest unemployment rates globally, demonstrating a strong and stable labor market. Its population of over 125 million people provides a massive domestic market, especially in urban centers like Tokyo and Osaka. The nation is also a global leader in sectors such as automotive, electronics, robotics, and finance, making it an ideal hub for both B2B and B2C operations. High internet penetration and a strong logistics network support seamless digital and physical commerce.

Japan operates under a transparent legal system, offering predictability and fairness in commercial disputes. The corporate tax rate currently stands around 30%, though various deductions and incentives are available depending on the business type and location. Companies must comply with strict accounting and reporting standards, but these requirements help build credibility and trust in the marketplace. Foreign businesses can fully own their Japanese entities, and intellectual property protections are among the most robust in the world.

Why Japan is a top destination for incorporation

Choosing Japan for business incorporation is more than a strategic move, it's a long-term investment in credibility, quality, and global reach. Japan’s business environment encourages innovation, stability, and international collaboration.

Setting up a company here signals to partners and clients that your business is serious, structured, and ready to operate at the highest standard.

You’re not just entering a market, you’re joining one of the most respected business ecosystems in the world.

Advanced economy with high consumer purchasing power

Japan’s consumers are known for their demand for quality and innovation, making the market both challenging and rewarding.

High disposable income levels and a culture of brand loyalty create ideal conditions for companies that offer premium products or services.

Moreover, the country’s appetite for international goods, particularly in sectors like food, fashion, healthcare, and tech, makes it highly attractive for foreign brands with a clear value proposition.

Stable legal framework and global trade agreements

Japan maintains a stable political system and legal environment, underpinned by reliable institutions and contract enforcement. This reduces risk and increases confidence for long-term investment.

It is also a party to multiple free trade agreements, including the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) and the EU-Japan Economic Partnership Agreement, offering companies in Japan favorable access to major international markets.

6 key advantages of incorporating in Japan

Incorporating a company in Japan offers more than just a local presence, it opens doors to credibility, competitive positioning, and long-term growth in one of the most advanced markets globally.

Here are six distinct advantages that make Japan an attractive destination for incorporation.

Japan’s consumer market is both mature and high-spending, with a strong demand for premium goods and services.

Businesses that deliver consistent quality and reliability can build long-term customer loyalty and brand equity in this environment.

With over 125 million residents and a dense urban population, the potential for growth, especially in sectors like healthcare, tech, retail, and finance, is substantial.

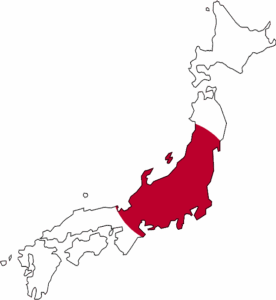

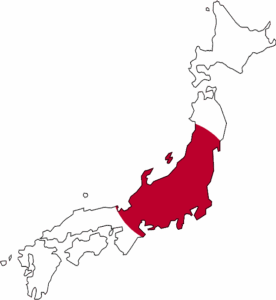

Japan’s location makes it a strategic launchpad for regional expansion. Proximity to major economies like China, South Korea, and Southeast Asia allows companies to manage operations and logistics efficiently across the entire region.

For businesses with a global footprint, having a base in Japan enhances supply chain resilience and accelerates time-to-market throughout Asia-Pacific.

Japan offers a transparent legal system, ensuring strong protection for shareholders, intellectual property, and contractual obligations. Foreign investors can own 100% of shares in a private limited company, giving full control over operations and strategy.

This legal clarity gives businesses the confidence to invest in long-term plans without excessive regulatory surprises or risks.

Incorporating in Japan gives access to numerous international trade agreements, including CPTPP and the EU-Japan Economic Partnership. These agreements lower tariffs and simplify market access to key global economies.

Additionally, Japan offers tax incentives and deductions for certain industries and investment zones, which can significantly improve profitability over time.

Its international tax treaties also help mitigate issues like double taxation for companies operating across borders.

Japan is known for its world-class infrastructure, including transportation, communications, and energy systems. This ensures smooth daily operations and reliable delivery of products and services.

Moreover, Japan’s highly educated, tech-savvy workforce is a major asset. Companies benefit from a culture of precision, discipline, and innovation that’s hard to replicate elsewhere.

Having a legal entity in Japan signals strength, commitment, and professionalism. It enhances a company’s global reputation, especially when working with partners, investors, or high-level clients.

Operating in Japan demonstrates that your business meets rigorous compliance standards and is prepared to compete on a global level. This kind of credibility is a powerful differentiator in international markets.

6 common challenges for foreign founders

While Japan offers a stable and rewarding business environment, foreign entrepreneurs often encounter specific obstacles during the incorporation process and early operations.

Understanding these challenges can help you navigate them more effectively and build a stronger foundation from day one.

Japanese is the primary language for all legal, administrative, and financial procedures. Most government documentation and forms are not available in English, which can lead to misunderstandings or delays if not handled properly.

Hiring bilingual legal and accounting professionals is often essential to ensure accurate communication and compliance.

A physical business address in Japan is mandatory for company registration. This must be secured before filing documents, and virtual offices are not always accepted depending on the business type.

Many founders face delays at this step, especially if they are unfamiliar with local leasing practices or zoning requirements.

To register a company, at least one resident representative director is required for most company structures.

For foreign entrepreneurs without Japanese residency, this often means appointing a local partner or using a professional nominee service.

This adds complexity and may require legal agreements to ensure alignment of interests and control.

Opening a corporate bank account in Japan can be surprisingly restrictive for newly established entities, especially those with foreign shareholders or directors.

Banks require proof of local operations and may deny applications without detailed business plans or local presence.

They also conduct Know your customer (KYC) procedures rigorously, which means extensive documentation and verification may be required.

Until registration is complete, founders must deposit the initial capital in a personal bank account in Japan, typically that of the representative director.

Japan's business culture values precision, documentation, and protocol.

Processes like registering the company seal (inkan), submitting tax notifications, and maintaining corporate records require meticulous attention to detail.

Missing a single form or misunderstanding a regulation can result in delays or compliance issues, making expert guidance a necessity rather than a luxury.

After incorporation, companies are required to register for tax and social insurance, even if operations haven't started. This includes corporate tax, consumption tax, and contributions to employee pension and health systems.

Failure to comply or late submissions can lead to penalties, so it’s critical to set up a reliable accounting and HR structure from the beginning.

Banking in Japan: what to expect

Establishing banking operations is a critical step when incorporating in Japan.

While the country offers a highly secure and technologically advanced banking system, foreign-owned companies often face stricter onboarding procedures, especially at the early stages.

Understanding the requirements upfront will help you avoid delays and streamline your company’s financial operations from day one.

Opening a corporate bank account

To open a corporate bank account in Japan, your company must already be legally registered.

This means completing all incorporation steps, including registering the company seal and receiving the certificate of incorporation.

Japanese banks are generally conservative and may conduct in-depth background checks on foreign founders, business plans, and funding sources before approval.

Required documents, resident director, and local address

Banks typically request a full package of documents: the Articles of Incorporation, company registry, personal ID of directors, proof of address, and business plans written in Japanese.

They also require a resident representative director to serve as the point of contact.

A local business address is essential. PO boxes and virtual offices are rarely accepted. The bank may request a lease agreement as proof of operations.

Taxation and compliance requirements

After incorporation, companies must register with the local tax office for corporate income tax, consumption tax, and other fiscal obligations.

The system is well-regulated and transparent, but strict in its enforcement.

It’s crucial to maintain accurate records and understand filing deadlines. Penalties for non-compliance can be severe, even for unintentional errors.

Corporate income tax, consumption tax, and social insurance)

Japan’s corporate income tax rate averages around 30%, depending on company size and profit levels. Businesses must also pay a 10% consumption tax on most goods and services.

If you hire employees, you are required to enroll them in national pension and health insurance schemes, and submit regular payroll-related filings. This adds a layer of complexity that requires proactive planning.

Accounting standards, annual filings, and local payroll rules

All companies in Japan must follow Japanese Generally Accepted Accounting Principles (J-GAAP) or International Financial Reporting Standards (IFRS), depending on the entity type. Yearly financial statements must be submitted to the tax office.

In addition, you must file annual reports and maintain detailed payroll records for all employees, even part-time staff.

Local rules around overtime pay, bonuses, and social insurance are enforced consistently.

Residency, visas, and foreign ownership

Foreign ownership is permitted in Japanese companies, and many foreign investors retain full equity in their local entities. However, to be actively involved in management or banking, at least one resident director is typically required.

If you intend to live and work in Japan, a visa is mandatory. Operating remotely can limit your access to key administrative functions.

Business manager visa and investor options

Entrepreneurs planning to live in Japan can apply for a Business Manager Visa, which requires proof of office space, investment capital (typically ¥5 million or more), and a sound business plan.

Alternatively, certain investors may qualify under long-term residency or investor schemes, depending on nationality and scale of investment.

Engaging immigration specialists early is highly recommended to choose the best path forward.

Company registration timeline

Registering a company in Japan involves several coordinated steps across multiple government offices.

While the process is structured and transparent, it demands attention to detail and preparation to avoid unnecessary delays.

Most businesses can complete the incorporation process in 2 to 4 weeks, assuming all documents are accurate and the representative structure is in place.

Legal Affairs Bureau, tax office, and other government bodies

The Legal Affairs Bureau (Homukyoku) is the main authority for company registration. All incorporation documents are submitted here, and the company is not legally formed until approval is granted.

You’ll also need to interact with the tax office, pension office, and potentially other agencies depending on your business type.

Each step is essential to ensure your company is compliant and fully operational.

Typical timeline: 2–4 weeks

With proper planning, the company can be incorporated in as little as two weeks. However, delays often occur due to missing documents, challenges in opening a local bank account, or the need to revise Articles of Incorporation.

Having a resident director, office address, and clear documentation from the outset is key to staying on schedule.

Step-by-step: how to incorporate a company in Japan

Most foreign investors select either a Kabushiki Kaisha (KK) or a Godo Kaisha (GK). KK is ideal for credibility and attracting partners, while GK is more flexible and easier to manage for small or medium-sized operations.

A physical office address in Japan is mandatory for registration.

Simultaneously, draft the Articles of Incorporation, which include your company’s name, business purpose, share capital, and director structure.

For KK entities, the Articles must be notarized at a notary office. Once notarized, the required capital is deposited into the personal bank account of the resident representative director, since company accounts cannot be opened at this stage.

Prepare and submit a complete set of documents to the Legal Affairs Bureau, including the notarized Articles (for KK), capital deposit certificate, seal registration, and agreements from directors and officers.

Upon approval, you will receive the Certificate of Company Registration and can create your official company seal (inkan). These are required for banking, contracts, and other formal transactions.

Notify the National Tax Agency of your company’s formation and register for corporate taxes and consumption tax. If hiring employees, enroll in social insurance, pension, and labor systems.

With your registration and compliance complete, you can now open a corporate bank account in the company’s name. Once the account is active, you're officially ready to begin business operations in Japan.

Japanese business culture & practices

Understanding the cultural context of doing business in Japan is just as important as navigating the legal and administrative processes.

Japanese business culture values formality, hierarchy, and long-term relationships, all of which play a key role in shaping negotiations, partnerships, and day-to-day operations.

Companies that take the time to respect these cultural nuances often enjoy greater trust and cooperation from local partners, clients, and institutions.

Formal, hierarchical, and relationship-focused

Japanese companies operate with a clear sense of hierarchy, where decisions are typically made through consensus and seniority is highly respected. Formality is expected in communication, especially in initial meetings.

Building trust takes time, but once established, business relationships in Japan are often remarkably stable and mutually beneficial. Respect, patience, and professionalism are essential.

Importance of precision, documentation, and long-term trust

In Japan, precision is not a preference, it’s a standard of conduct. Everything from contracts to invoices must be carefully documented, and small errors can undermine credibility.

Business success in Japan often hinges on your ability to deliver consistent quality, meet commitments, and foster trust through attention to detail. Long-term thinking is prioritized over quick wins.

How C2Z Advisory can help you succeed in Japan

Our expertise goes beyond paperwork. We support your journey with an end-to-end approach designed to minimize friction and maximize your ability to operate with confidence in the Japanese market.

We understand the expectations of local stakeholders and help you align your business practices with local norms, legal standards, and cultural expectations.

Legal incorporation, visa, and tax compliance support

From preparing your Articles of Incorporation to securing your Business Manager Visa, we provide full legal support to ensure your company is compliant from day one.

We assist with corporate tax registration, social insurance setup, and ensure you meet all filing deadlines to avoid penalties and build a strong compliance record.

Banking setup, office address services, and local representation

We help open your corporate bank account, provide a verified registered office address, and offer local representation services when needed, especially if you don’t yet have a resident director.

With a global footprint and a local presence, we deliver seamless execution across every phase of your Japan market entry.

Frequently asked questions

Understanding the finer details of company formation in Japan can help you plan with more confidence.

Below are answers to common questions foreign entrepreneurs often ask when preparing to incorporate in Japan.

Yes, 100% foreign ownership is allowed in both Kabushiki Kaisha (KK) and Godo Kaisha (GK) structures. There are no nationality restrictions on shareholders, giving international founders full control over their business.

However, at least one resident representative director is required for registration, depending on the company type.

A Kabushiki Kaisha (KK) is a joint-stock company that offers higher credibility, especially with banks, partners, and government institutions. It involves more formalities, including board meetings and notarization of documents.

A Godo Kaisha (GK) is a simplified LLC-style structure, with fewer legal obligations and lower startup costs. It’s ideal for small to mid-sized businesses or ventures testing the market.

The typical incorporation process takes 2 to 4 weeks, assuming all documents are properly prepared and submitted.

This timeline includes steps like notarization, capital deposit, registration filing, and post-registration tasks.

Delays can occur if there are issues with documentation, address verification, or appointing a resident director.

Companies in Japan are subject to corporate income tax, consumption tax, and local enterprise tax. The effective corporate tax rate averages around 30%, depending on business size and profit level.

Filing requirements include annual financial statements, tax returns, and, if you hire employees, social insurance and payroll reporting.

No, you do not need to live in Japan to own or operate a business. However, most company types require a resident director for registration and to open a corporate bank account.

If you plan to be actively involved in management, you may need to apply for a Business Manager Visa or similar residency status.